Calculating Your CD Earnings

Certificates of Deposit (CDs) offer a predictable way to grow your savings. This guide provides a clear, step-by-step approach to calculating CD returns, empowering you to make informed decisions about your investments.

Understanding CD Basics

A CD is like a special savings account where you agree to deposit a sum of money (the principal) for a specific period (the term) at a fixed interest rate. In return for committing your funds, the bank rewards you with interest, allowing your money to grow steadily over time.

Factors Influencing CD Earnings

Several key ingredients contribute to the recipe of your CD returns:

- Principal: Your initial investment forms the base for earnings. A larger principal has the potential to generate more interest.

- Annual Percentage Yield (APY): The APY represents the actual annual interest earned, factoring in the effect of compounding. It’s the most accurate way to compare CD offers. Focus on APY, not just the basic interest rate.

- Term Length: Longer terms often come with higher APYs, offering the possibility of greater returns but also tying up your money for a more extended period.

- Compounding Frequency: Compounding is the process of earning interest on your accumulated interest. The more frequently interest compounds (e.g., daily vs. annually), the more your investment may grow, although the difference can be subtle.

Calculating CD Return: The Formula

The formula for calculating the future value (A) of a CD is:

A = P (1 + r/n)^(nt)

Where:

- A: Future value (the total amount you’ll receive at maturity)

- P: Principal (your initial deposit)

- r: Annual interest rate (expressed as a decimal)

- n: Number of times interest compounds per year

- t: Term length (in years)

Example

Let’s say you invest $2,000 (P) for 3 years (t) at a 4% annual interest rate (r = 0.04) compounded monthly (n = 12):

A = 2000 (1 + 0.04/12)^(12*3)

A ≈ $2,253.77

You would likely have about $2,253.77 at maturity.

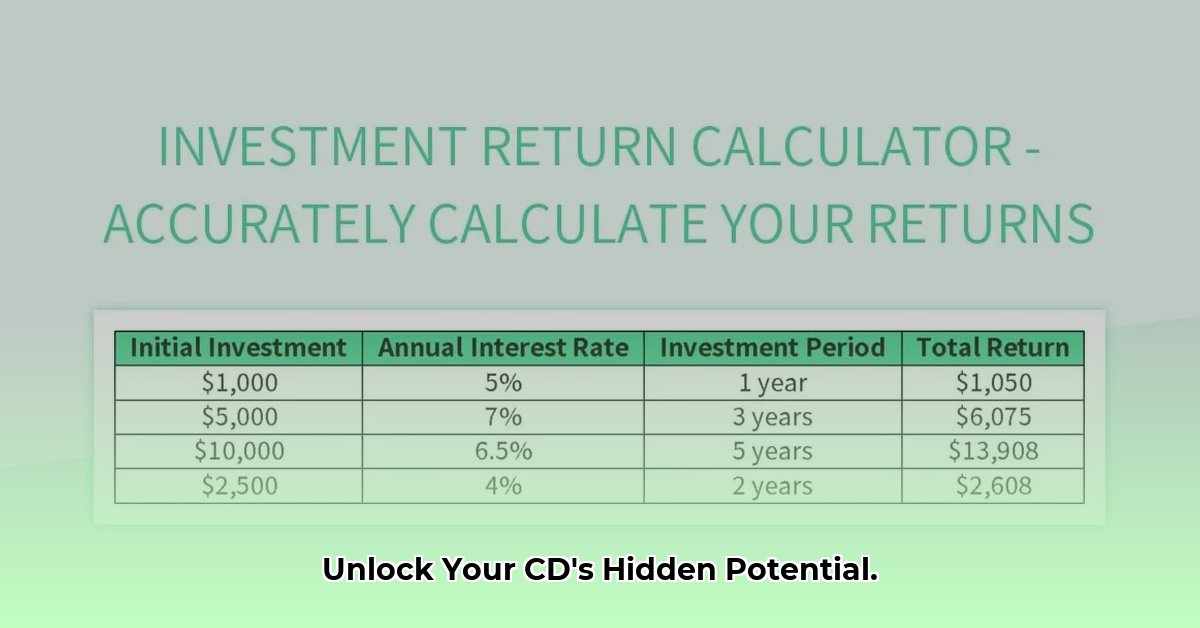

Online CD Calculators

Simplify the process by using online CD calculators. Input the required information, and the calculator will instantly provide your potential return.

Early Withdrawal Penalties

Withdrawing funds before maturity can result in penalties, potentially diminishing your returns. Be sure to understand the penalty terms before investing.

CD Laddering: A Strategy for Optimized Returns

CD laddering involves dividing your investment across multiple CDs with staggered maturity dates. This strategy offers a balance of higher potential returns from longer-term CDs and access to funds as shorter-term CDs mature.

Choosing the Right CD

Selecting the appropriate CD requires balancing various factors:

- Financial Goals: What are you saving for? Short-term goals might benefit from shorter-term CDs, while longer-term goals could benefit from longer-term CDs.

- Risk Tolerance: CDs are considered low-risk investments, but tying up your money means less liquidity.

- Interest Rate Environment: Current market conditions and interest rate trends can influence CD rates.

- Inflation: Consider the potential impact of inflation. If inflation outpaces your CD’s APY, your real return could be negative.

| Factor | Impact on CD Earnings |

|---|---|

| Initial Deposit | A larger deposit generally means more potential interest. |

| APY | A higher APY leads to greater earnings growth. |

| Term Length | Longer terms may offer higher APYs but reduce liquidity. |

| Compounding Frequency | More frequent compounding generally suggests a slightly higher APY. |

Understanding CD Interest Rates and APY in Detail

While we’ve touched on APY, let’s delve deeper into its significance. APY provides the true measure of a CD’s earning potential by accounting for the impact of compounding, rather than relying solely on a basic interest rate. This makes it easier to compare different CD offers with varying interest rates and compounding frequencies.

The APY Formula

While online calculators simplify the process, understanding the underlying math can be valuable. The APY formula is:

APY = (1 + r/n)^n - 1

Where:

- APY: Annual Percentage Yield

- r: Annual interest rate (as a decimal)

- n: Number of compounding periods per year

Compounding’s Impact

Compounding frequency affects the final APY. More frequent compounding (daily, monthly) may result in a slightly higher APY compared to less frequent compounding (quarterly, annually). Use the formula or APY calculator to compare various offers.

APR vs. APY

Don’t confuse APR (Annual Percentage Rate) with APY. APR represents the simple interest rate without compounding, while APY gives you the true, effective annual yield. Always focus on APY when comparing CD options.

Using the CD Return Formula: A Step-by-Step Guide

Let’s break down the CD calculation formula step by step:

- Gather Your Information: Obtain the principal (P), annual interest rate (r), compounding frequency (n), and term length (t).

- Convert to Decimal: Express the interest rate as a decimal (e.g., 4% becomes 0.04).

- Apply the Formula: Plug the values into the formula:

A = P (1 + r/n)^(nt) - Calculate: Solve the equation to determine the future value (A).

Further Considerations

- Inflation: Be mindful of inflation’s impact on your real return, especially with longer-term CDs. Some research suggests that investing in shorter-term CDs will provide better results if an upcoming increase in interest rates is predicted. High inflation paired with a low interest rate can erode returns.

- Taxes: Interest earned on CDs is typically taxable. Consult a tax advisor for guidance.

- FDIC Insurance: CDs are generally insured by the FDIC up to $250,000 per depositor, per insured bank.

- Seek Professional Advice: If you’re unsure about which CD is right for you, consider consulting a financial advisor for personalized guidance.

By understanding these key concepts and using the provided tools and strategies, you can effectively calculate CD returns and make informed investment decisions aligned with your financial goals. Remember, staying informed and adapting your strategies as financial landscapes change is always beneficial. Always research thoroughly and compare multiple financial institutions’ offerings for the best CD rates available.

- Windows App to Stop Apps Running in Background Saves Battery - February 2, 2026

- How To Spot Android Apps Running In The Background - February 1, 2026

- Android App to Stop Background Apps and Save Battery - January 31, 2026